Latest Industrial Production in Manufacturing Update – 18 Month Outlook

Posted By : Armada Corporate Intelligence | Date : March 8, 2023The Armada Strategic Intelligence System (ASIS) is a set of 8 predictive models covering various aspects of durable manufacturing. The capstone model is one that covers industrial production in manufacturing overall, which also includes both durable and nondurable manufacturing. Thus far, this model has performed well, coming in with 98.8% accuracy 3 months in advance and 93.3% accurate 6 months out.

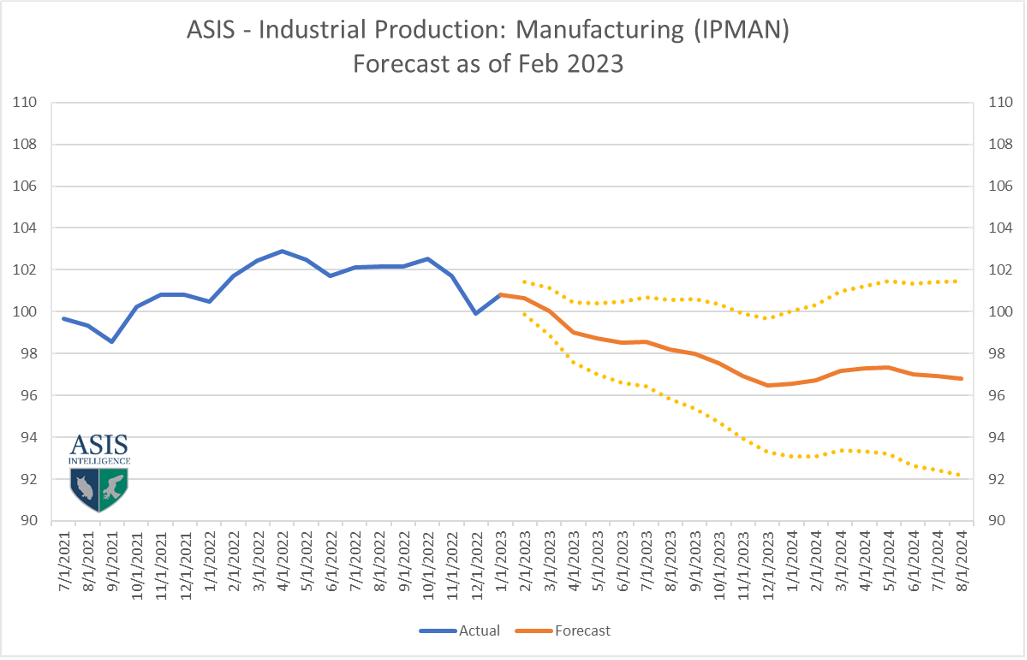

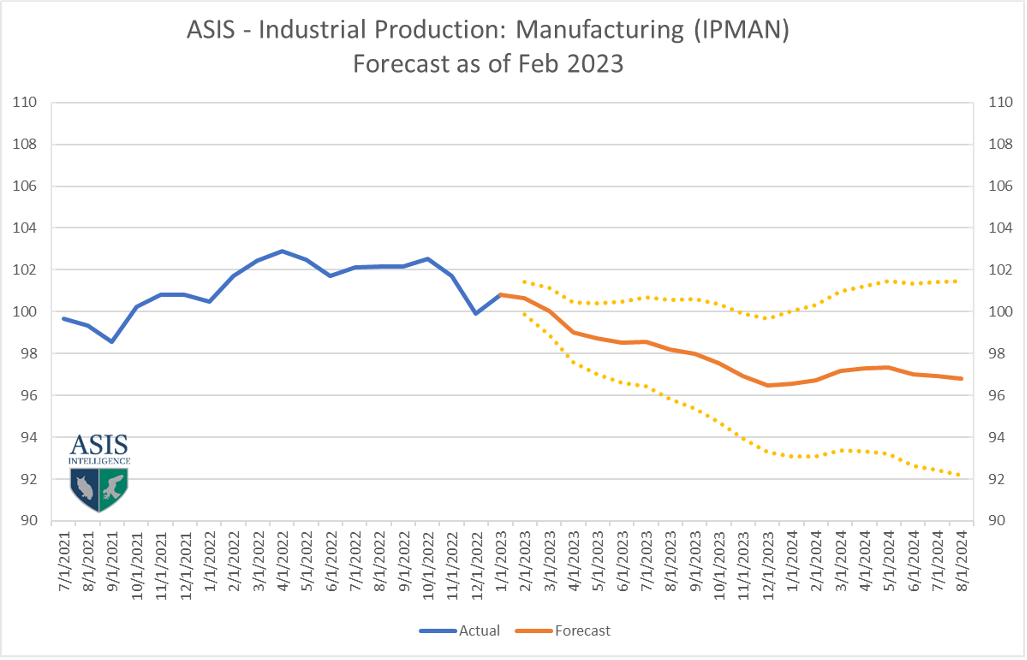

The latest model output shows what many of us have feared in manufacturing, there is a swoon of sorts in the model. The model predicts that the volume of manufacturing activity (on a broad basis) is likely to be falling for the next three quarters through the end of 2023 before beginning to lift slightly in Q1 of 2024.

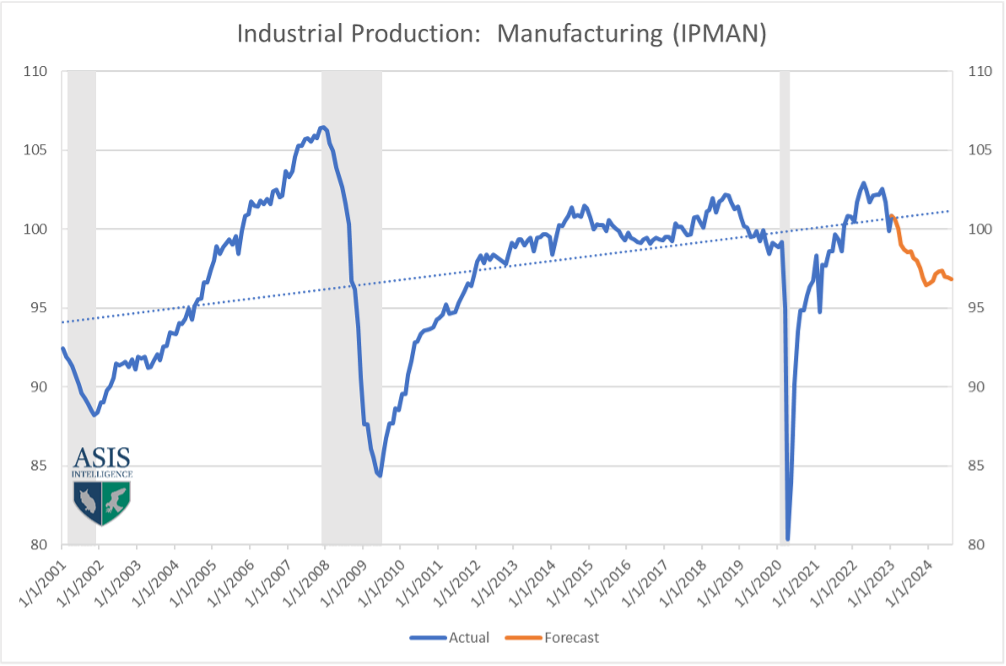

The long-term graph of the model shows the downturn a bit more dramatically. Although it can look a bit frightening at first blush, compared to other fluctuations over time, it is a mild downturn. We have seen similar downturns in periods between 2018 and late 2019 just prior to the pandemic. Most of us tend to look at the long term trendline (the blue dotted line) and versus what we have seen historically, this would be considered to be a recessionary prediction for the sector. But the downturn is soft. This would be akin to what many economists are predicting as a “soft landing” or “shallow recession” for the industrial production complex.

Much of this outlook depends on what happens with inventories for wholesalers, OEMs, and retailers. Too many of those sectors are sitting on inventory levels that are far too high. Coming out of December, among those industries that handle products in the United States specifically, approximately 70% of them were sitting “heavy” relative to their inventory levels in 2019. This period was just before the pandemic, and it was at the end of a ten-year period of “normalizing” inventory levels relative to sales (or better said: supply chains were optimized at that time). Companies were efficient and had their inventories tuned closely to consumption rates (not quite just-in-time but very close). Comparing them to that period is likely the most accurate for where most of them will attempt to re-adjust their ongoing inventory carrying levels to (especially with recession risk growing).

One of the important factors to understand is that these models are updated monthly. Each includes thousands of simulations that use up to 22 different economic metric inputs (modeled over 20 years) to develop these views. Although the data in the first 12 months is usually stable, the volatility shows up at the tail end of the curve between 13 and 18 months out.

Armada has other models also included in the ASIS covering predictions for automotive, aerospace, computers and electronics, machinery, electrical equipment and appliances, fabricated metals, and primary metals. Interested parties can sign up for a free trial to the ASIS (no credit card required) and the cost of subscription is inexpensive on a monthly basis and you can cancel at any time.