Mini Banking Crisis Impact on Manufacturing

Posted By : Armada Corporate Intelligence | Date : March 21, 2023The global banking system is going through some challenging conditions and the failure of several high-profile banks has the business community wondering how it will affect them. For manufacturing, the impact could be multi-dimensional.

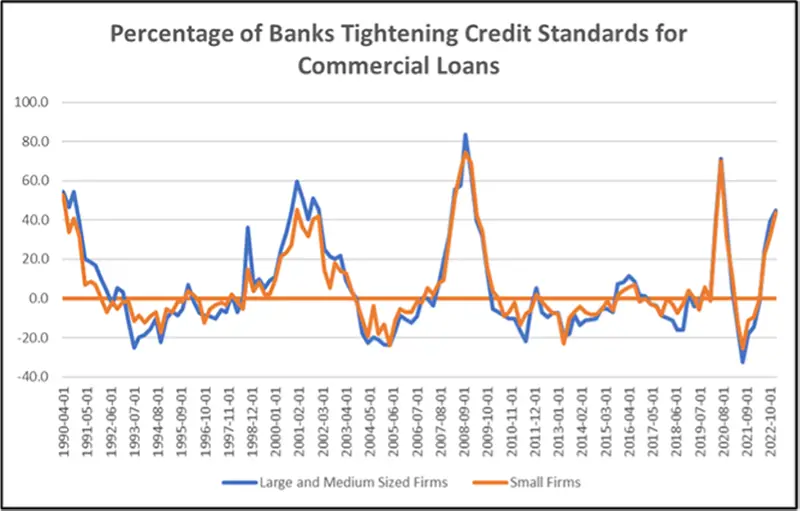

First, manufacturers obviously rely on banks for liquidity. Prior to the start of the banking crisis in 2023, banks had already started a tightening process that was hitting the industrial production sector. The chart below using data from the Federal Reserve shows that banks have tightened credit standards for large, medium, and small industrial and commercial firms to their fourth highest levels in history. Both are now showing more than 43% of banks lending to those sectors are now tightening conditions.

Also keep in mind that these tightening conditions measures were taken from Federal Reserve surveys conducted in Q4 prior to the current mini banking crisis. As new data for Q1 is released next month, there will likely be data showing that these conditions have tightened even further amid the challenges going through the banking system.

Secondly, upstream and downstream conditions will play into manufacturer’s operations. As suppliers for manufacturers experiencing tightening of their credit conditions, they will place tougher credit standards on their manufacturing partners. That will likely push some manufacturers to improve their liquidity which could take on several different forms. They may trim inventories to free up cash, trim labor and other operating costs, or go after some higher cost borrowing to meet their liquidity needs. They may also lean on suppliers and look for more accommodative terms, especially from those suppliers with strong cash positions that will allow it (and it could give those suppliers with more accommodative terms to build some competitive advantage).

Downstream, manufacturers may put more pressure on their customers, and they may tighten credit terms to reduce their risk and exposure. Those additional costs downstream will also increase inflationary pressure overall. Costs are going to rise because of rising financial sector costs, fees, and bailout ramifications (Federal backstops that are funded by increasing costs to banks either through the FDIC system or another backstop funding mechanism – those fees eventually must be paid for by someone whether it is the taxpayer, bank, bank customer, or bank investor).

The bottom line is that there is going to be further tightening in the banking industry beyond the credit conditions tightening that has already taken place. Whether that tightening is stringent enough to shut off borrowing and eventually create a deeper risk of recession is another story altogether. Conditions are still changing, and the industry is still shaking itself out. The majority of banks are on firm footing and have strong balance sheets overall. In fact, of the 4,700 small and regional banks in the US, less than 100 are currently on a watch list of those that might have some greater risk. The industry overall is still very strong. But contagion is risky, and it drives fear into the hearts of many executives in the financial sector. That will change their psyche when it comes to lending, and what was perhaps a safe risk for them a year ago and one that would fit into their investment risk profile, may not fit in their portfolio today.