Long and Short of Consumer Price Index and Tariffs

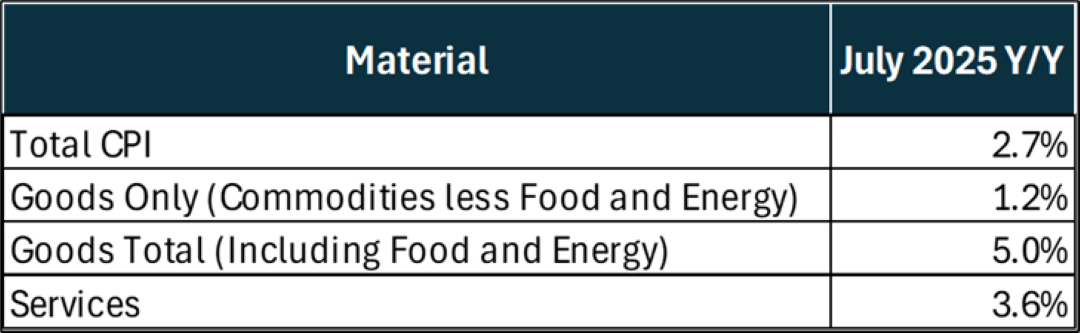

August 17, 2025The short answer on tariffs and inflation through the Consumer Price Index (CPI) is that they were having little impact. The bottom line is that tariff inflation was marginal at best and you really have to dig to find it.

If I had a discussion with most of you, you can all tell me where price inflation has hit you (or where you have passed it on to somebody). But at a macro level, it is being partially eaten throughout the supply chain and most of the impact is still muted.

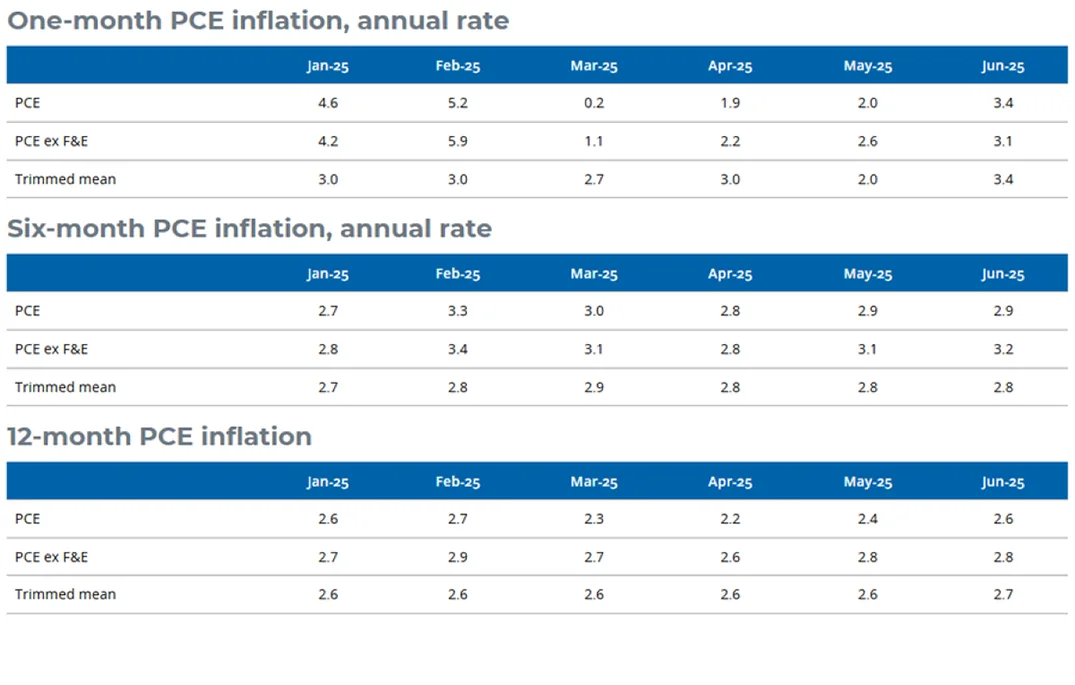

I heard one of the staunchest opponents to tariffs say on Wednesday that they anticipate a one-time hit to inflation of 3 tenths of a percent pushing overall inflation (measured in the Fed’s favorite Personal Consumption Expenditures PCE – not in the CPI reflected in this article) to 3.1%. That’s nothing close to what we experienced in 2021-2023 during the global supply chain crisis. And even the Fed is forecasting it to quickly fall back down to 2.4% in 2026. …

Read more about Long and Short of Consumer Price Index and Tariffs